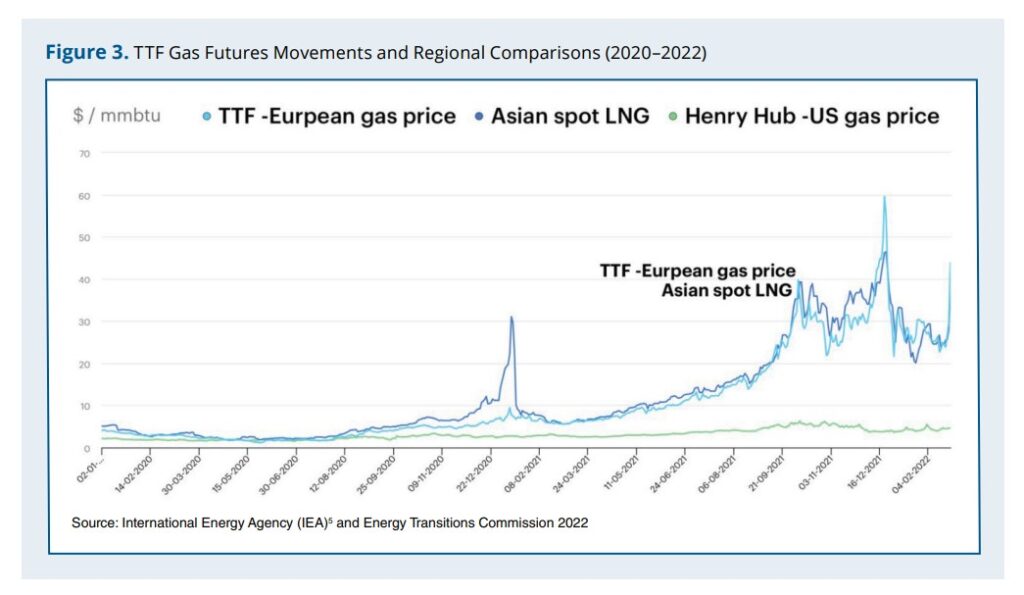

This article shows how TTF futures became the crisis barometer during Europe’s 2021–23 gas shock, spiking after Russia’s cutoff and Nord Stream sabotage, and why liquidity keeps TTF central to LNG pricing and hedging. It argues the EU gas-storage regulation amplified volatility, while ACER’s DES LNG assessment improves transparency but lacks depth to replace TTF; the authors recommend pairing ACER/Platts […]