The Brent crude price bull run continued for a sixth straight day on Friday, with the front-month contract settling at a fresh one-year high of USD 59.34/barrel.

The month-ahead WTI contract rallied for a fifth straight day to close at a year-high of USD 56.85/barrel range. The crude price rally through the week was prompted by signs of economic growth in the US, strong draws on US crude storage and signs of oil demand recovery in major consumers – India and China.

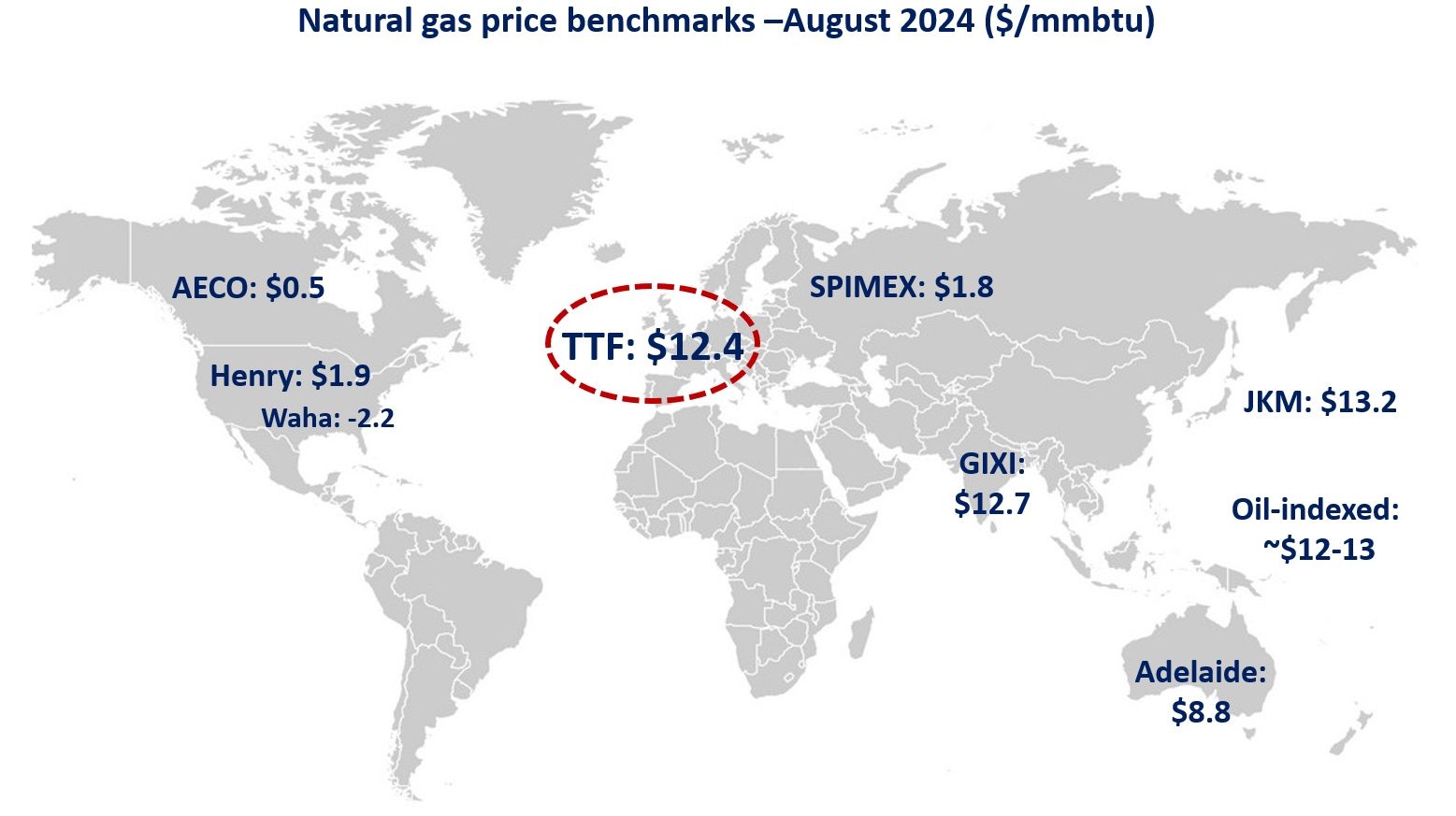

US natural gas benchmark Henry Hub rallied above USD 3/MMBtu during trading on Friday, however the front-month contract fell by 3.4% to settle at USD 2.84/MMBtu. Across the pond, European gas prices continued to rally, with the front-month UK NBP price settling 1.5% higher, and the month-ahead Dutch TTF price increasing by 2% to settle at the equivalent of USD 6.48/MMBtu.

CME’s JKM futures contract recorded a marginal gain, closing 0.5% higher at USD 8.39/MMBtu.

The European carbon price recovered on Friday, rallying by 2.5% to end the week back in the EUR 38/tonne range.

Source: Gas Strategies

Follow on Twitter:

[tfws username=”GasStrategies” height=”700″ width=”350″ theme=”light” color=”#FAB81E” tweets=”2″ header=”yes” footer=”yes” borders=”yes” scrollbar=”yes” background=”yes”]