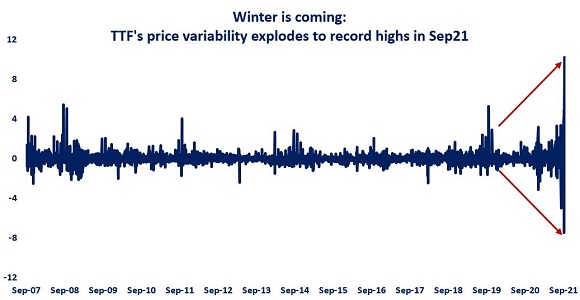

The heating season is turning on: gas price volatility calmed down in November as high storage levels and healthy gas supply kept gas prices under control.

In Europe, TTF month-ahead prices remained broadly flat at $14.5/mmbtu, as price pressures coming from higher demand (rescom and industry) was counterbalanced by the downward price pressures stemming from record high storage levels (96% full) and the ramp-up of Norwegian piped gas deliveries.

In Asia, JKM prices rose by 4% month-on-moth to $17/mmbtu amidst higher LNG imports from China (+15% yoy) and India (+14% yoy). Spot LNG prices are now trading at a hefty premium of $4-6/mmbtu compared to oil-indexed prices, incentivising buyers to maximise their offtake volumes under long-term contracts.

In the US, Henry Hub prices slipped by 10% compared to Oct and averaged at $2.7/mmbtu. Above average storage levels and strong domestic production growth continues to weigh on gas prices and incentivises higher gas burn in the power sector which is set to reach a new record this year.

What is your view? How will gas prices evolve through the remainder of the heating season? Will December bring back volatility?

Source: Greg MOLNAR