European gas prices rebounded significantly yesterday (January 13), supported by the strong drop in Norwegian flows (down to 328 mm cm/day on average, compared to 342 mm cm/day on Wednesday, due to an unplanned outage at the Troll gas field); the outage is expected to end on 17 January.

Asia JKM prices sent mixed signals: -15.19% on the spot, to €68.741/MWh; +13.66% for the March 2022 contract, to €78.399/MWh.

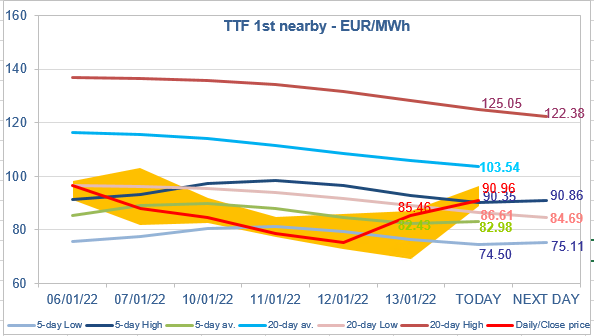

At the close, NBP ICE February 2022 prices increased by 24.990 p/th day-on-day (+13.88%), to 204.970 p/th. TTF ICE February 2022 prices were up by €10.31 (+13.71%), closing at €85.460/MWh. On the far curve, TTF ICE Cal 2023 prices were up by 35 euro cents (+0.82%), closing at €43.648/MWh.

Yesterday’s price hike reminded us of a simple reality: in a context of persistent weakness of Russian flows, so that the situation of stocks does not deteriorate further, European gas systems need high Norwegian supply AND high LNG supply. As soon as this condition is not verified, an upward pressure will be exerted on prices.

TTF ICE February 2022 prices thus closed yesterday above the 5-day average, as a first step to reverse the downtrend. They are extending gains this morning. Indeed, Russia yesterday’s declarations that talks with the West over the situation around Ukraine have hit a dead end tend to add a risk premium to prices. However, the lower levels of Asia JKM prices and technical selling could help limit the magnitude of the rise.

Source: EnergyScan