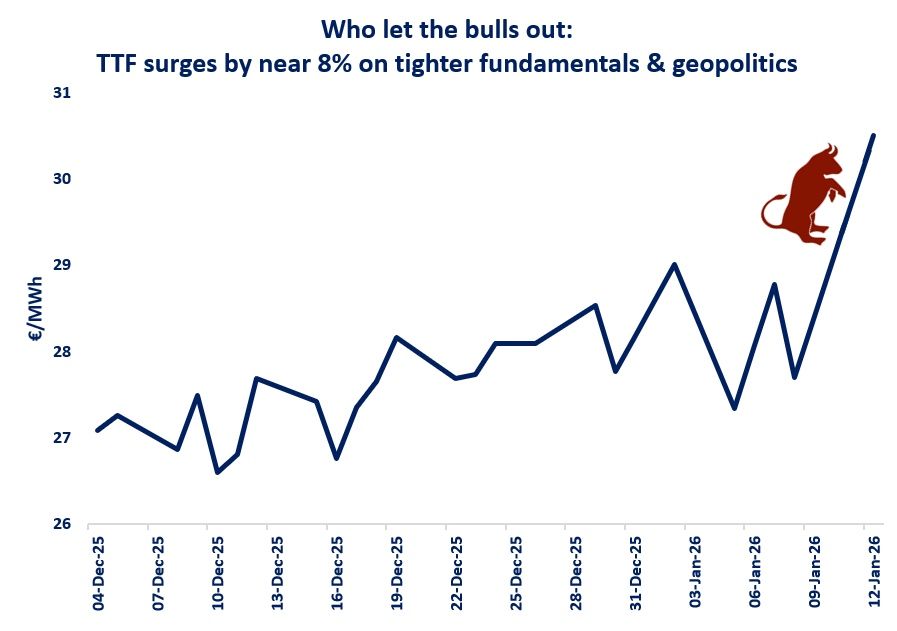

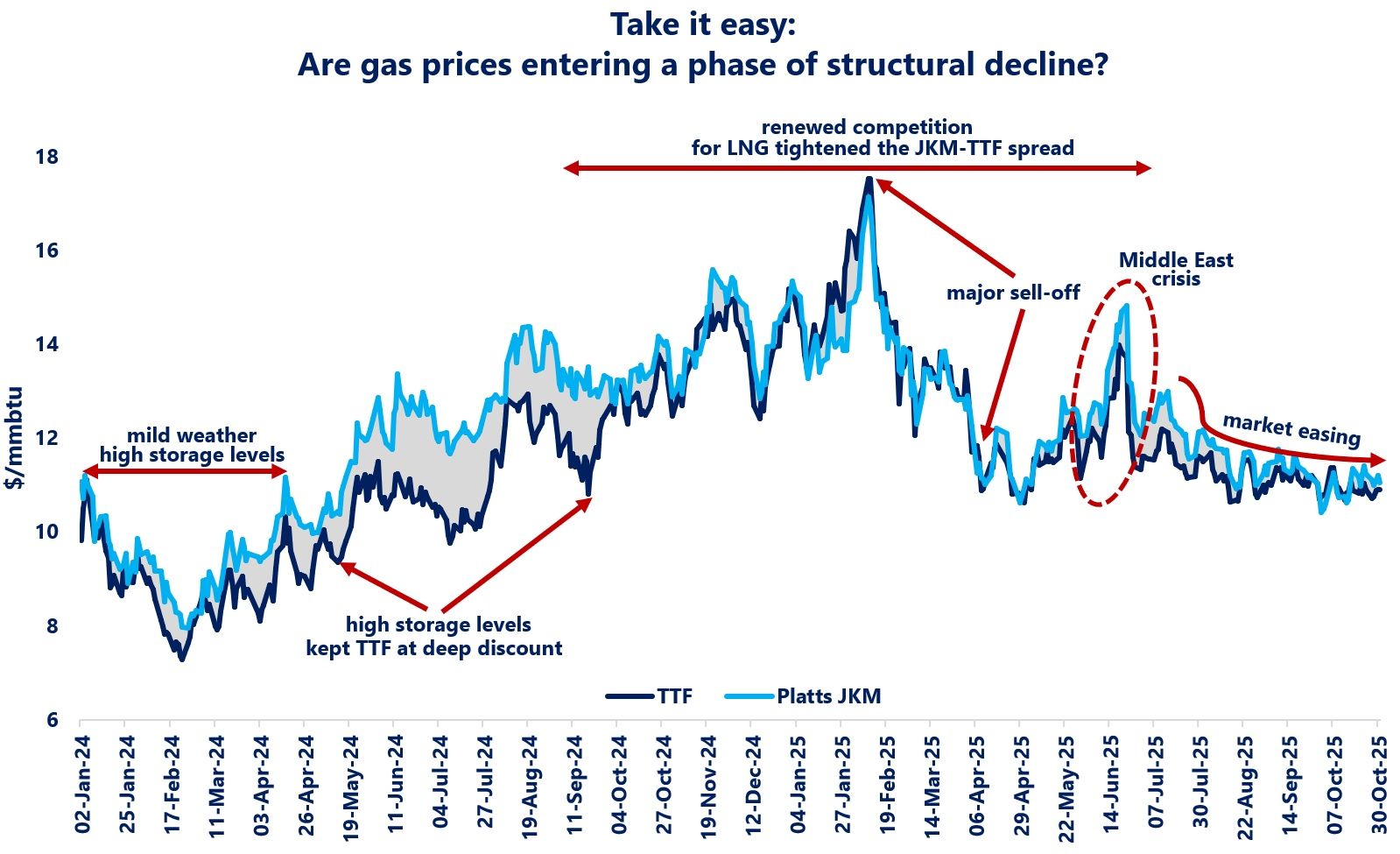

Although gas prices in Europe were rising almost continuously between April and early October, this year has most clearly demonstrated what particular region sets the tone for the global LNG market. After a long break, European terminals started to receive large quantities of vessels only in recent months, which among other things eased the supply/demand situation. But Asia’s imports slowed down just for a while, and with colder weather approaching, the region’s players should hunt for cargoes with renewed vigour.

In October, aggregated LNG imports to Europe amounted to more than 7 million tonnes, increasing by 60pc from this year’s lowest monthly level in July. Deliveries to NWE and Mediterranean are expected to grow further in November, according to Kpler data.

Europe’s energy crisis reached its acute stage in late Q3 and early Q4, resulting in unprecedentedly high gas prices, which in turn helped to significantly improve the economics of delivering LNG to the region as compared to the previous months in summer. For instance, a trader buying a cargo on an FOB basis in the US Gulf in late September for delivery to the Dutch TTF could make five times as much as in early July. It is not surprising, then, that the European regas facilities imported over 2 million tonnes from the US in October, for the first time in five months.

Now what about US cargo shipments to Asian countries, given a significant rise in Europe-bound supplies?

Actually, there was almost no change in Asia’s LNG receipts from the US in the past three months, while September’s and October’s imports were down just 10pc compared with the figure for July, when cooling demand peaked within the region. East Asia remained a priority export destination for US LNG during all that time, supported by consistently high prices, with Europe drawing spot cargoes away from Chile and Argentina. Unable to withstand the rising cost of LNG available in the market, the two countries cut their imports by 65pc in the last two months.

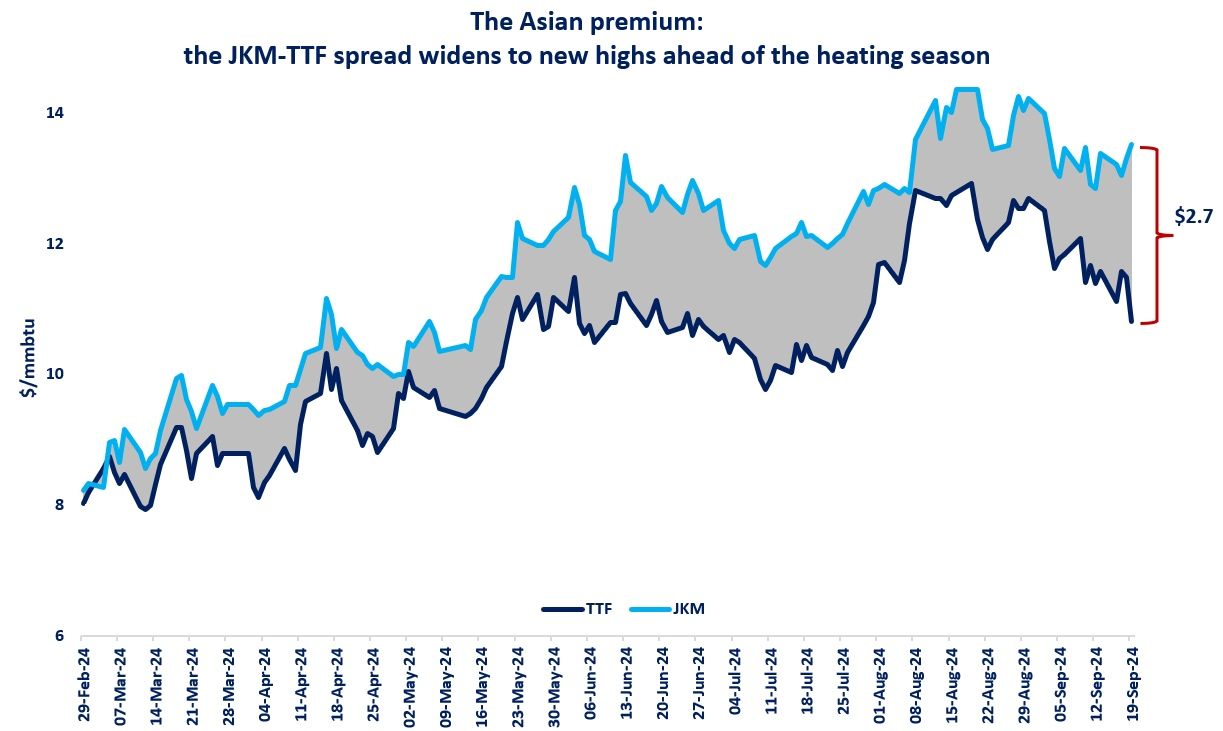

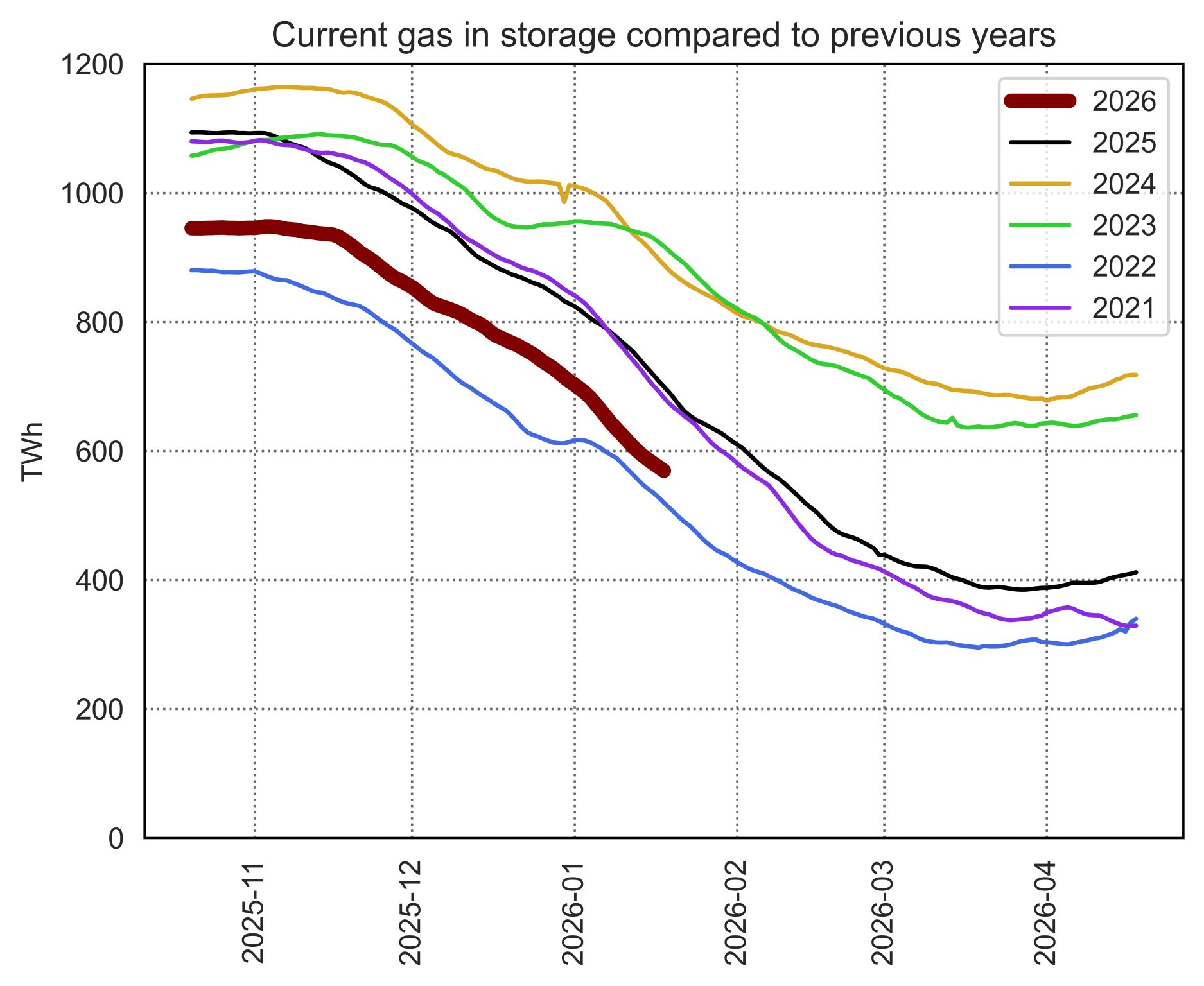

Already this month, US LNG imports to Asia are expected to reach the highest level since July 2021. Having learned from the previous winter, Asian buyers now have much more LNG in the storage tanks than a year ago, but La-Niña will keep players in the region on their toes in the coming months. And European importers can only dream of having a calm life, as the JKM-TTF spread for December-delivered cargoes indicates.

Source: Yakov Grabar (LinkedIn)