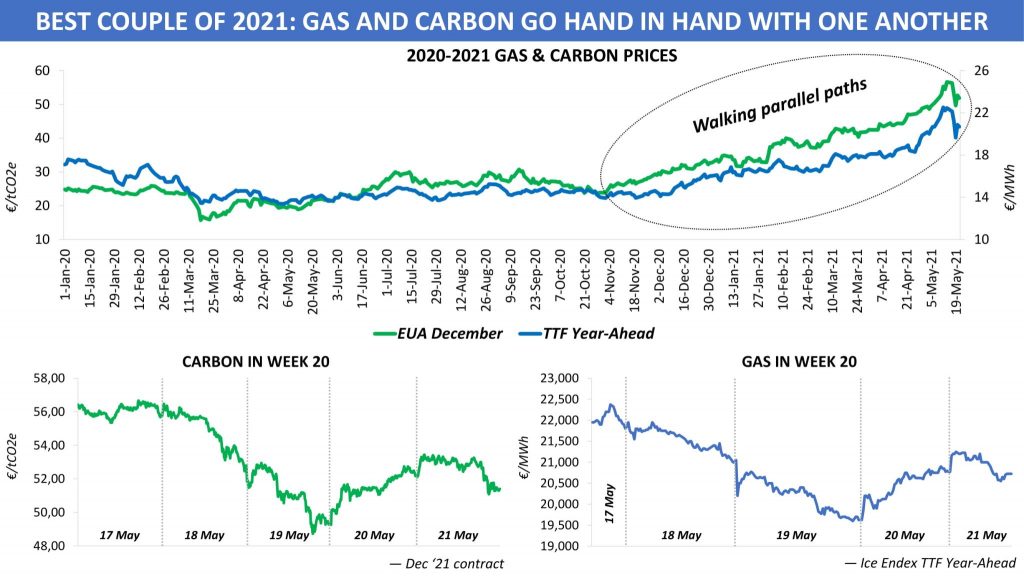

European gas prices were steadily rising right up until this week, when the rhythm of the market changed from smooth to jumpy one. The bulk of the blame for that lies with carbon, which increasingly attracts the attention of gas traders in 2021.

In the first three days of the past trading week, TTF YA dipped by about 12pc, just as the benchmark Dec ’21 EUA did over the same period. Both EUAs and gas were moving in parallel in the later half of the week as well, the difference being that the prices rebounded from Wed lows.

This week’s developments are fully in line with the process of increasing carbon-gas correlation, with extra dynamism coming from speculators who flooded the emissions market in the past year. In that context, it has become critical to closely monitor how EUAs react to the stock market movements, which in turn affects the gas curve.

Correlation between the two commodities works equally the other way round. Due to its impact on EUA demand, gas often sets the tone for the emissions market, especially at times when carbon lacks reference points of its own. It is this two-way relationship that is the key for understanding the synchronization between carbon and gas prices.

Source: Yakov GRABAR (connect on LinkedIn)