TTF gas prices surged sharply as nuclear outages, lingering cold weather and rising carbon prices added fresh momentum to the winter rally. However, the TTF index is still trading around 30% below the January 2025 levels.

TTF surged by nearly 8% today (January 12) to over €30/MWh, recording its strongest daily increase since June 2025, when the Middle East crisis was driving up gas price volatility.

Several factors are contributing to the current bull run:

(1) Flamanville outage: France’s Flamanville nuclear plant (4.3 GW) is set to stay offline until the end of January following the outage suffered during the Goretti storm. Flamanville alone accounts for almost 7% of France’s nuclear capacity;

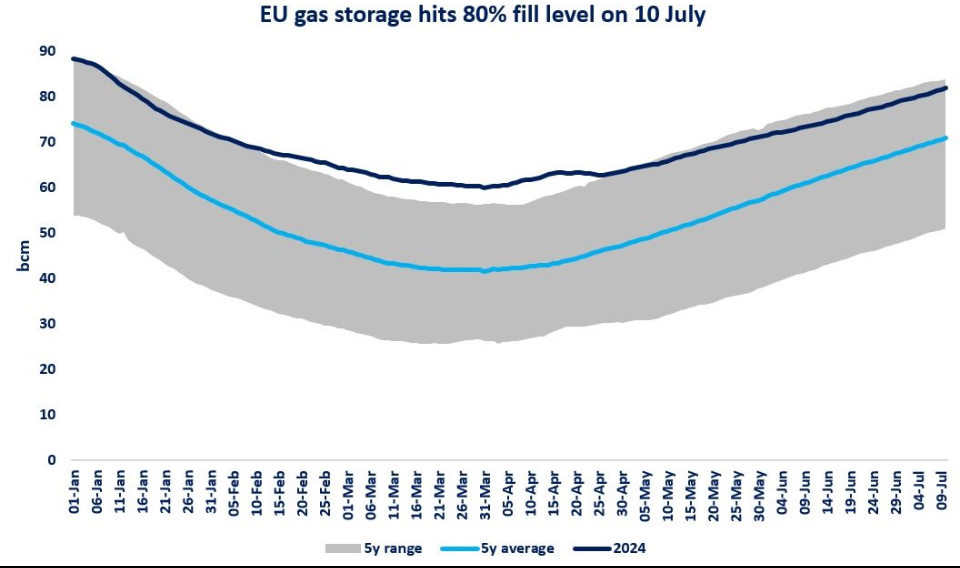

(2) Keep it cool: While temperatures are turning milder in northwest Europe, Central and Eastern Europe continue to face a harsh cold spell, supporting stronger gas demand. This could further widen the EU’s gas storage deficit, already standing at 12 bcm compared to last year.

Meanwhile, the first cold spell is set to hit northeast China, which could boost competition for LNG;

(3) Carbon bulls: EUA prices surged to just over €90/t, their highest level in two-and-a-half years, amid expectations of tighter supply;

(4) Geopolitics: While Iran’s gas exports are limited and regional (to Iraq and Türkiye), the situation adds further nervousness to an already agitated market.

And while the current bull run is impressive, TTF prices are still trading around 30% below their January 2025 levels.

What is your view? How long will the bull run last? Could this be short-lived as the unfolding LNG wave starts to feed the bears? How do you see the winter market evolving?

Source: Greg MOLNAR