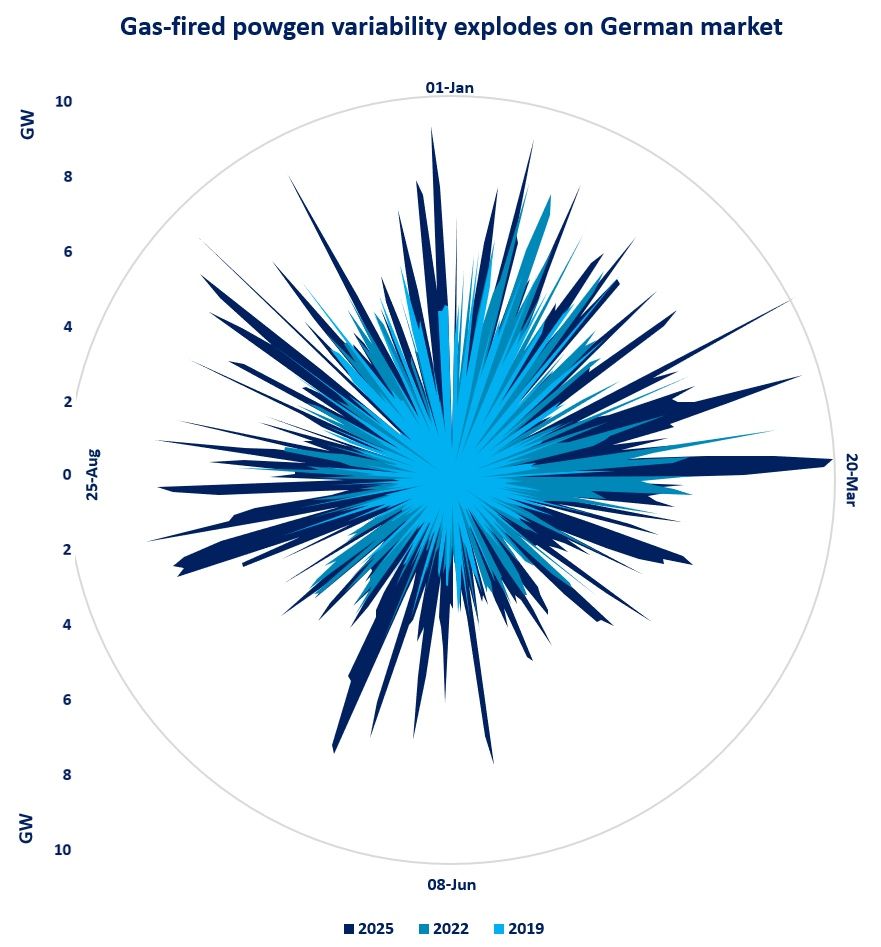

The intraday variability of German gas-fired power generation has more than doubled since 2019 and is set to reach a new all-time high in 2025, highlighting the growing role of gas-fired power plants in balancing the power system.

Intraday variability is a key metric for assessing flexibility requirements through a trading day. Here it is measured as the difference between the maximum and minimum output of quarter-hourly gas-fired power generation.

The intraday variability of German gas-fired power generation surged by 40% compared to last year and has more than doubled compared to 2019.

There are several drivers behind this:

(1) Wind volatility:

Wind generation displayed a particularly hectic pattern this year. While Germany’s wind output was subdued due to slow wind speeds, the absolute short-term variability of wind output was up by 20% compared to 2019.

(2) Phase-out of nuclear:

Germany closed its last nuclear power plants in April 2023. The nuclear phase-out not only led to the loss of low-carbon electricity supply, but also reduced the flexibility of the overall German power system (due to the loss of modulation capacity) and increased Germany’s reliance on more volatile power imports.

(3) The gradual phase-out of coal-based generation (14 GW since 2019):

This means that German gas-fired power plants are playing an increasingly important role in providing flexibility services to the electricity system, including by backing up weather-dependent, variable renewables.

The role of wind is particularly evident when looking at intraday patterns: the intraday variability of gas-fired power generation surged to a record high of 10 GW on 19 March, when wind output fell by 90% through the day. This drove up gas-fired generation by almost 300% between the morning and peak evening hours.

More volatile generation patterns are naturally supporting greater short-term price variability. The variability of German day-ahead prices almost tripled since 2019, which is certainly a good news for the trading community, but also highlights that the power system might be under the strain…

Germany’s decision to expand further its gas-fired power fleet by at least 8 GW by early 2030s indicates that the flexibility role of gas-based generation is here to stay and is expected to gain further importance… and this will naturally support the growing interaction between gas- and electricity pricing dynamics.

Source: Greg MOLNAR