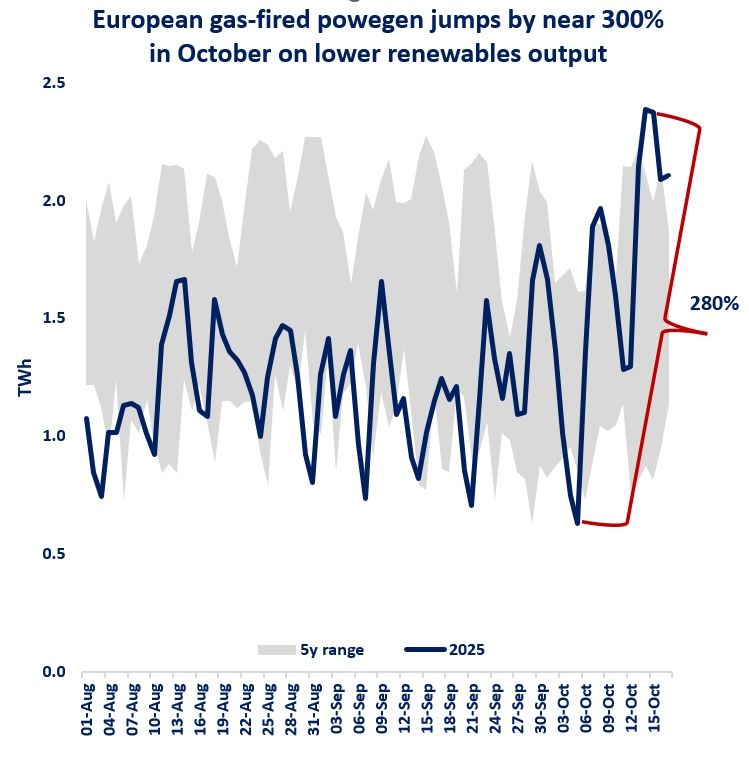

If you need a back-up: gas-fired powgen surged by near 300% in the first half of October amid plummeting renewables power output and higher seasonal electricity demand.

Gas-fired powgen grew by near 50% in the first half of October compared to the same period of last year. this strong growth was primarily driven by weak hydro availability (down by 28%) and slower wind speeds, driving down wind generation by almost 13% yoy.

The intra-month movements are even more impressive: gas-fired powgen surged by near 300% between 5 and 17 Oct, while wind output plummeted by 65% during the same period. lower hydro, less sunlight and colder seasonal temperatures are also contributing to higher gas-based generation.

These episodes of lower renewables output continue to highlight the key role of flexible gas-fired power plants in ensuring power system stability and electricity supply security.

Not surprisingly, stronger gas-to-power demand turned gas storage sites from injections to withdrawals, much earlier than in previous years.

This is naturally impacting storage build-up: net storage injections in the first half of October were down by more than tenfold compared to last year.

Wind power output is becoming a key driver behind winter gas demand in Europe, while the influence of wind speeds on short-term gas pricing dynamics is set to further rise in the coming years, with the growing back-up role of gas-fired power plants in the European electricity system.

What is your view? how will the role of gas-fired power plants evolve? what is your outlook for this winter? could we face another windless winter?

Source: Greg MOLNAR