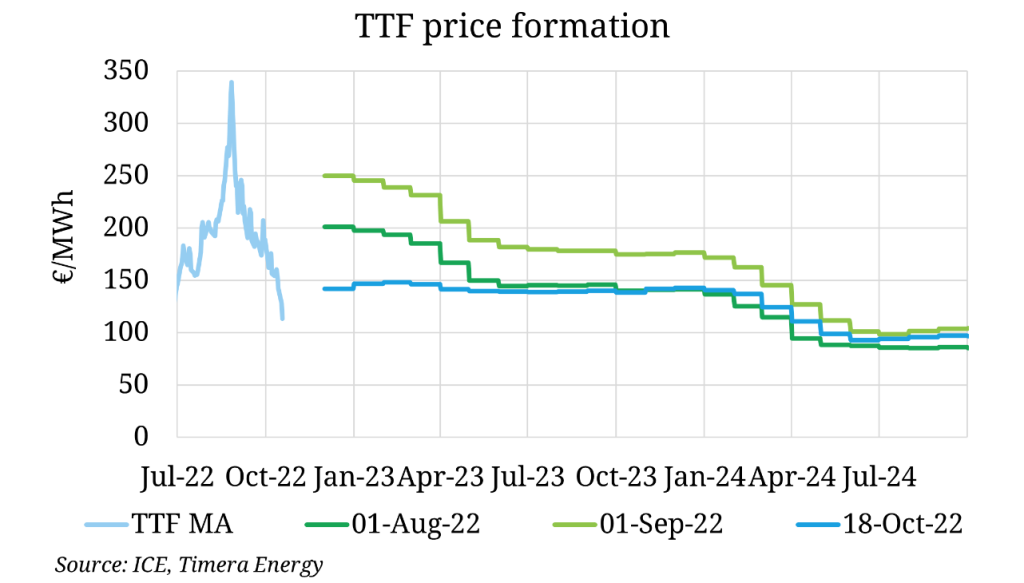

The TTF month ahead price has collapsed from a peak of 339 €/MWh on Aug 26th to 113 €/MWh on Oct 18th. A mild start to winter and continued strength in LNG deliveries has helped further build already healthy European stock levels, reducing expectations around the scale of the required demand response this winter.

The gas crisis is however by no means over. While prices along the curve have fallen, the decrease has been steeper on winter contracts than Summer 2023, leading to a narrowing of the seasonal spread. This reflects concerns around the increasingly challenging gas supply environment in 2023 and ability to meet European stock mandates.

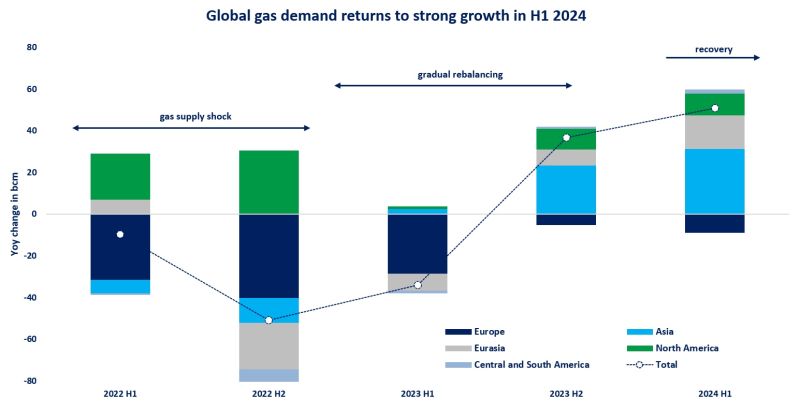

As discussed in our winter outlook, the scale of the challenge will be in part dependent on where stocks sit coming out of winter. But Europe is likely to need to offset around 40 bcm of additional lost Russian flows, a volume which LNG alone cannot meet given a lack of new global liquefaction capacity, limited further demand elasticity in Asia and European regasification capacity constraints. As such, focus will continue to be on demand side reductions next year.

Source: Timera Energy