Most comments about the current situation on the European gas market are about supply-side developments, for obvious reasons. At the same time, this year has also seen remarkable changes on the demand side, especially in gas consumption from the industrial sector which has to adapt to new price environment faster than other fuel users.

Chemicals industry, metal producers, fertilizer plants, etc., have been facing a steep increase in production costs across Europe since late 2021, when gas contracts started to set record after record. And the longer energy prices stay at unprecedentedly high levels, the more destructive impact they have on industrial gas demand.

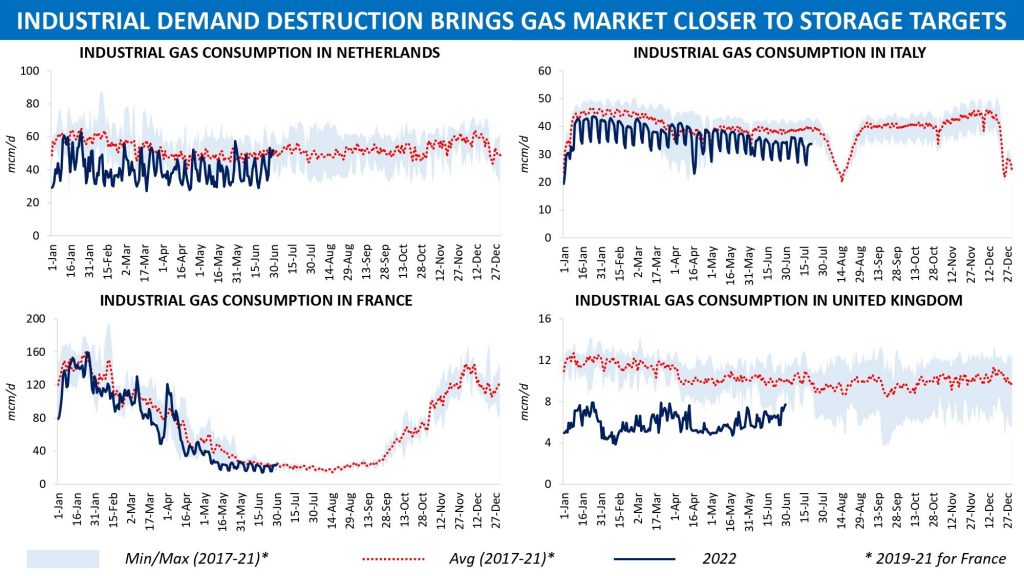

Within Northwest Europe, French and Dutch industrial consumers have reduced gas consumption by 17pc and 23pc respectively so far this injection season as compared to the same period in 2021. In the UK, demand for natural gas in the industrial seсtor, albeit insignificant in terms of absolute numbers, has dropped by more than a third year on year. Italy witnessed a decline in daily average industrial gas consumption to about 35 mcm/d between 1 April and 22 July 2022, down 10pc from a year earlier.

You’ll pardon me for not providing data on Germany, as it takes some time to collect consumption statistics from all of the country’s TSOs. There is hardly any doubt, however, that gas use in the German industry has also been constrained this year. By the way, if you have relevant data on Europe’s largest economy at your disposal, please feel free to share it in the comments section – everyone would be interested to see the exact number, 100pc sure.

On its own, gas demand destruction among industrial users of course cannot be regarded as a positive development, particularly given potential challenges related to the process of bringing affected production facilities back into operation. But in the context of preparing for the coming winter season, lower consumption serves to mitigate the negative effects of tight supply in the gas market.

Source: Yakov Grabar (LinkedIn)