The July 2021 Gas price rose 3.3% to 62.71p/therm last week as UK Continental Shelf gas production remained impacted by maintenance outages at the Forties pipeline system and an extended outage at Barrow North. Meanwhile InterconnectorUK, which connects the gas markets between the UK and Belgium, is also scheduled to be on maintenance until 16th June.

In contrast, the July 2021 Power price saw a small decrease of 0.9% to £73.25/MWh, as losses in the carbon market were more significant than modest gas gains. UK power prices continue to be largely led by Continental European carbon and power prices, largely thanks to coal remaining a significant source of power generation.

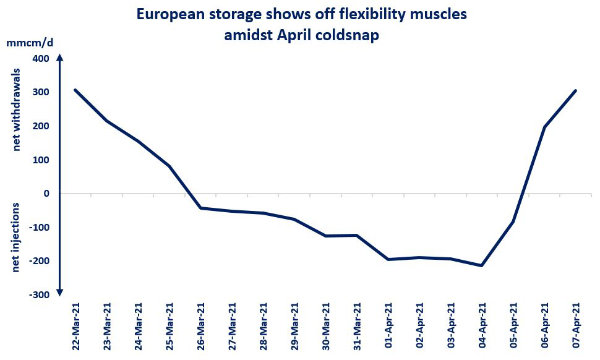

The Oct 2021 12 Month Gas price rose 0.8% to 58.53p/therm. This is driven by European sentiment where gas storage still sits at just 39% of maximum capacity, compared to 75% at the same point last year. The rate of LNG deliveries to Europe has been slow to react to rising prices, but an increase in LNG cargoes over the next month should ensure solid send-out, keep the system well-supplied and gradually start to refill storages, which sit at just 18% in the UK.

The Oct 2021 12 Month Power price saw a small decline of 0.9% to £68.76/MWh, following carbon prices lower.

Carbon remains a key price driver for UK and European power and any significant movement is likely to be critical for the direction of UK energy prices in both the short and long term.

Source: Beond Group