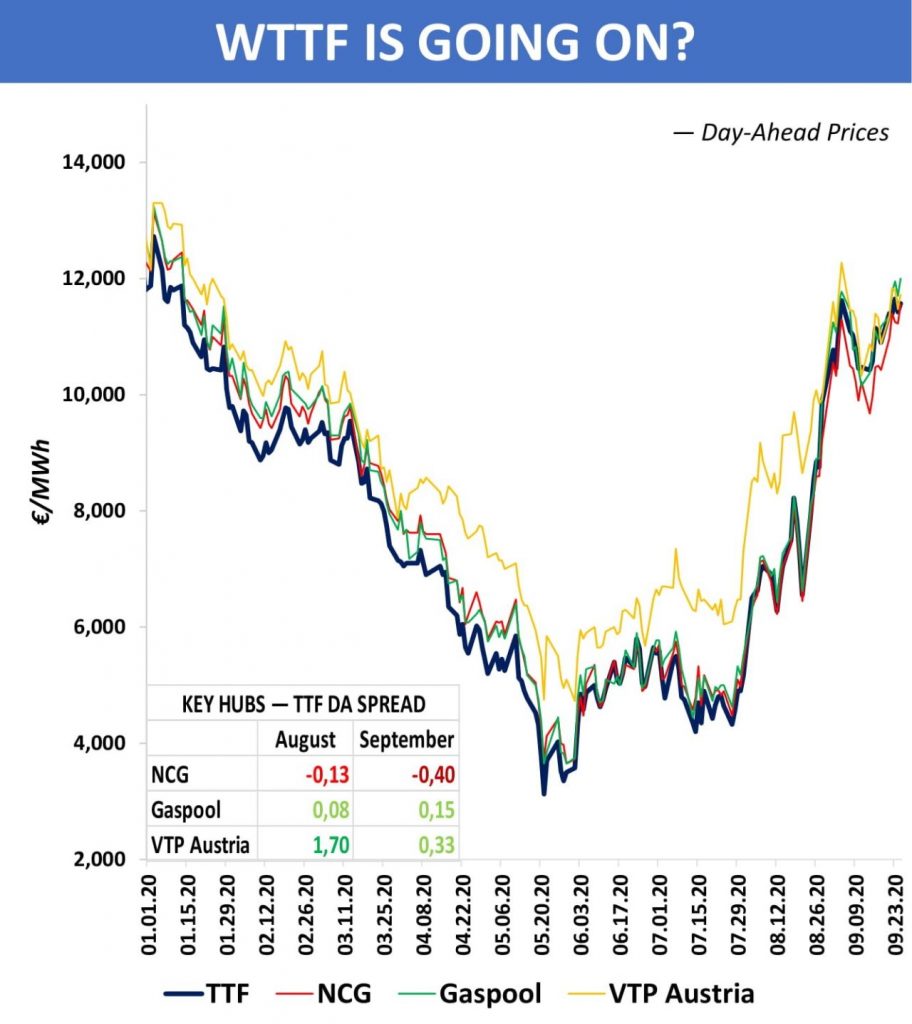

(Yakov Grabar) It is quite unusual for TTF spot prices to be at such a high level compared to other key European trade areas as the market has witnessed in September. This month, Day-Ahead product at the most liquid regional hub has been assessed noticeably higher than at the neighbouring NCG and has remained close to parity with Gaspool. The average spread between VTP Austria and TTF has actually narrowed almost five times over the last month.

There can be a number of reasons for an impressive increase in the cost of TTF volumes for immediate delivery, including limited gas production in Norway that provides Netherlands with the largest flow, modest LNG imports as well as higher injection rates in the Dutch UGS in comparison with Germany or Austria.

However, what is more interesting than looking through explanations of TTF gaining additional weight over other hubs is to understand whether the situation of that sort is a one-off event or the market will experience it more often in the near future. With lower production from Dutch fields and more trades on the single German hub after NCG and Gaspool merger an ‘expensive’ TTF can become a sort of common practice.

What are your thoughts?

Connect with Yakov & see original post on LinkedIn