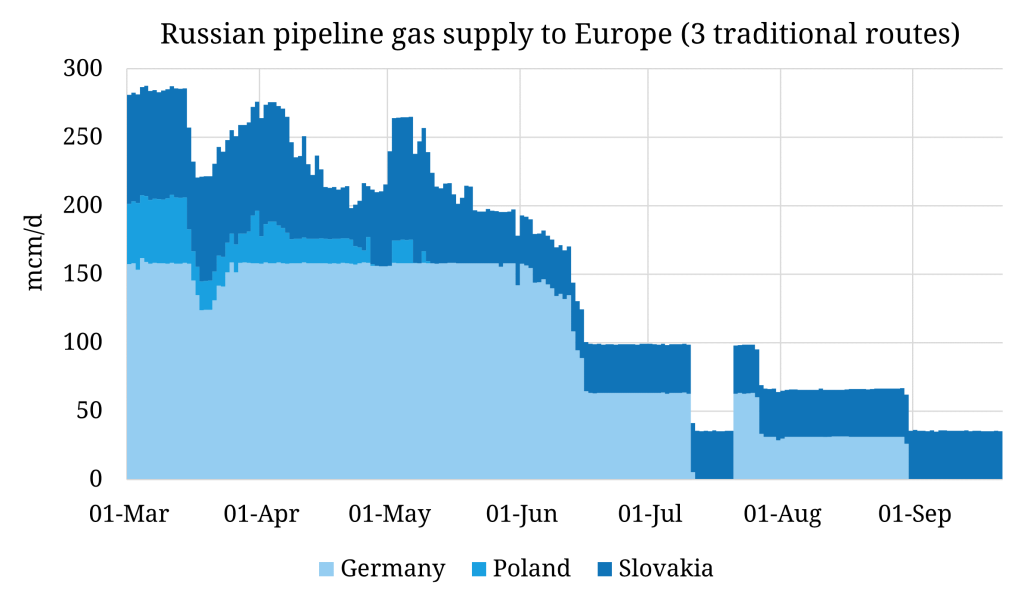

The European pivot away from Russian gas following the invasion of Ukraine was heralded with EU targets to reduce Russian supplies to zero by 2027. Russia have had shorter timelines in mind. Flows have been reduced unilaterally from an average of 263 mcm/d in March via Germany, Poland and Slovakia (through Ukraine) to only 36 mcm/d in September. The reasons provided have variously included maintenance, rouble payment conflicts, and Western sanctions.

There is limited further room for Russia to reduce (routes via Turkey aside) to use as leverage, in a week that Russia escalate the conflict by mobilising reservists. The low flows already cause two key issues however:

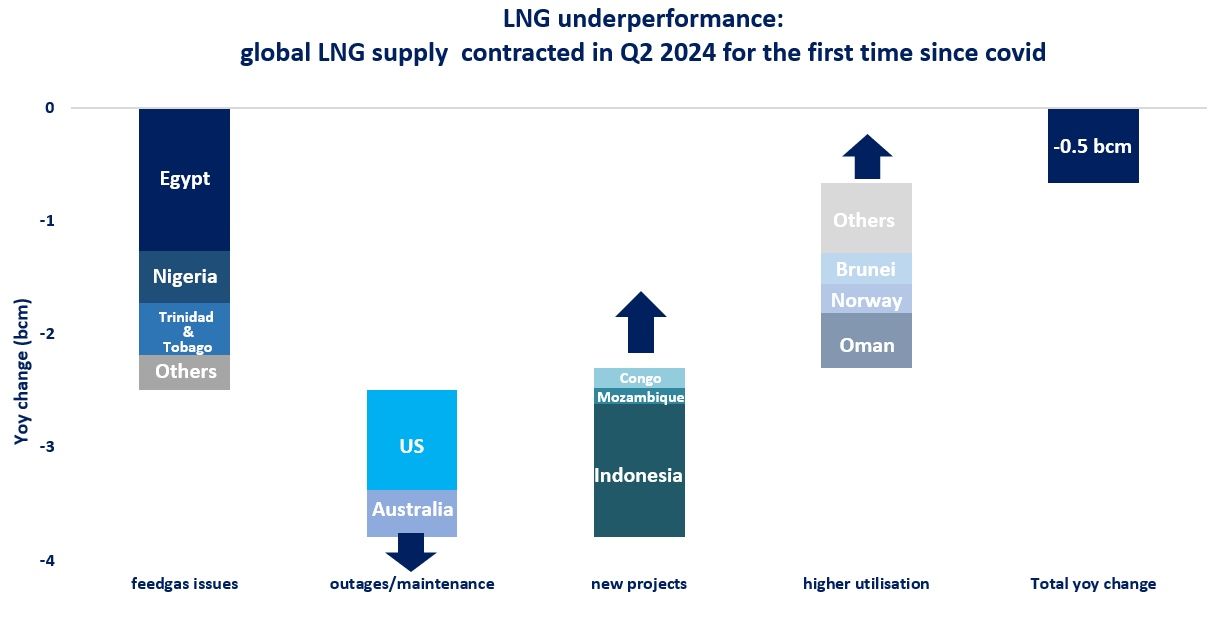

While new FSRUs are being developed, it is unlikely to be until the end of next year before 40 bcma of incremental regas capacity comes online, and Europe faces a significant challenge to source that volume of available LNG in the global market given the lack of new supply.

Source: Timera Energy