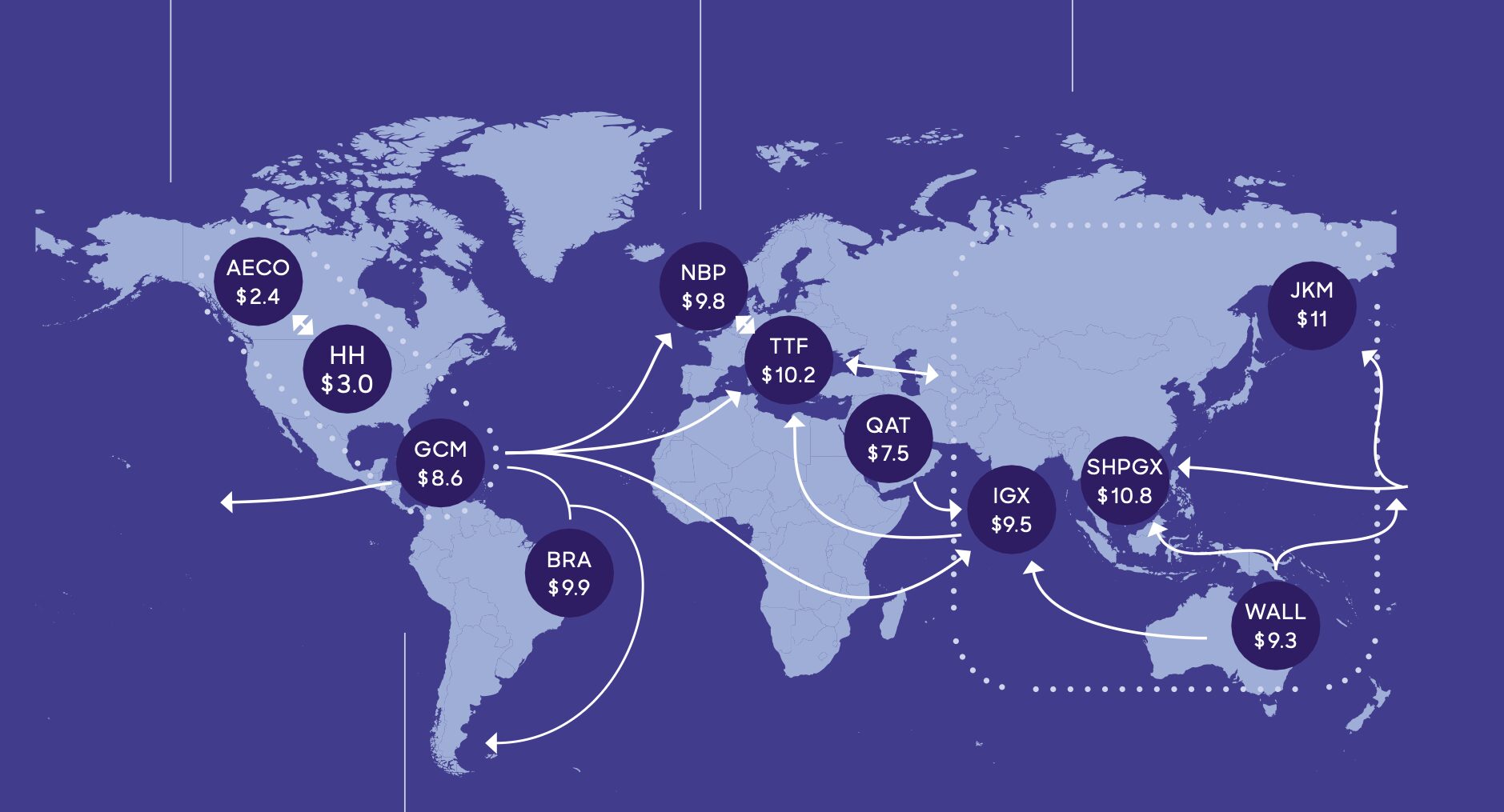

Today, the market uncertainties created by COVID-19, and the related negative demand shock, are one example of a situation where take-or-pay provisions in long-term contracts shore-up the continued viability of debt service of certain ongoing LNG or gas projects to existing lenders in the face of such a situation. Source: Kim Talus, Scott Looper, and Luke Burns, OGEL