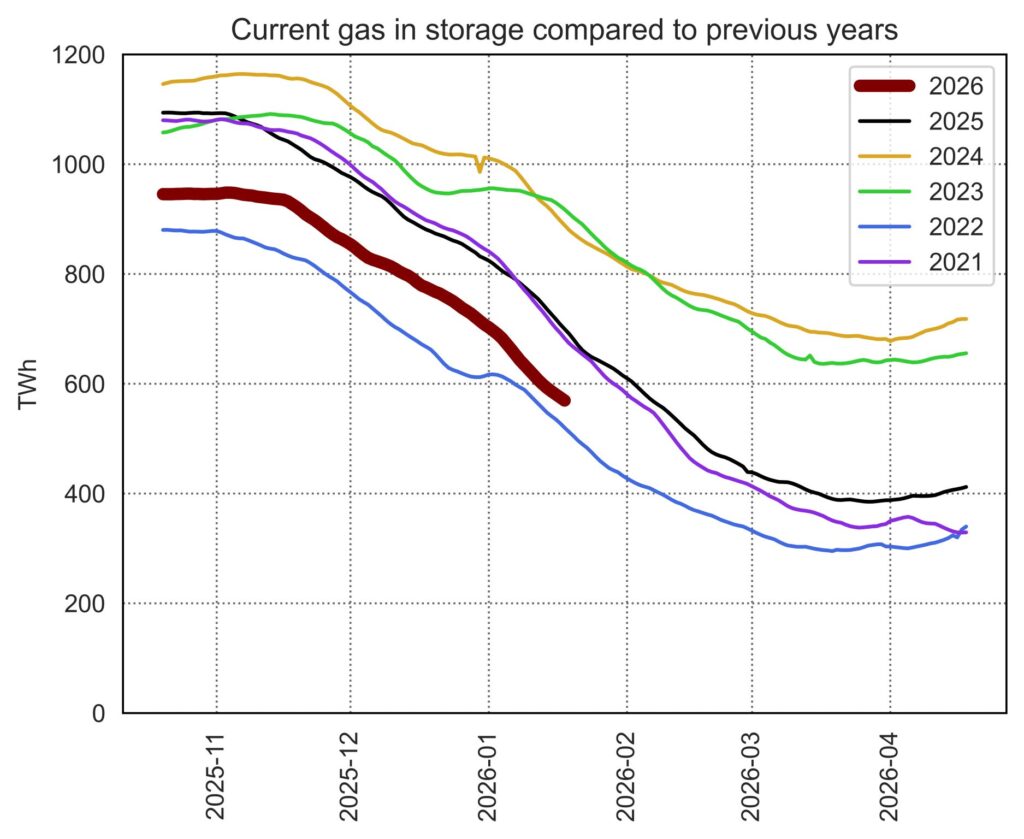

The European gas market is tightening, with European gas storage increasingly acting as the key pressure point through which recent demand and flow dynamics are being absorbed.

Below are the key numbers for European gas demand and storage withdrawals since 1 January:

Relatively low levels of gas in storage will continue to make prices highly volatile in the coming weeks, and potentially until the end of the winter. This exposure to higher volatility is a structural feature of lower European security of gas supply and stronger exposure to LNG imports.

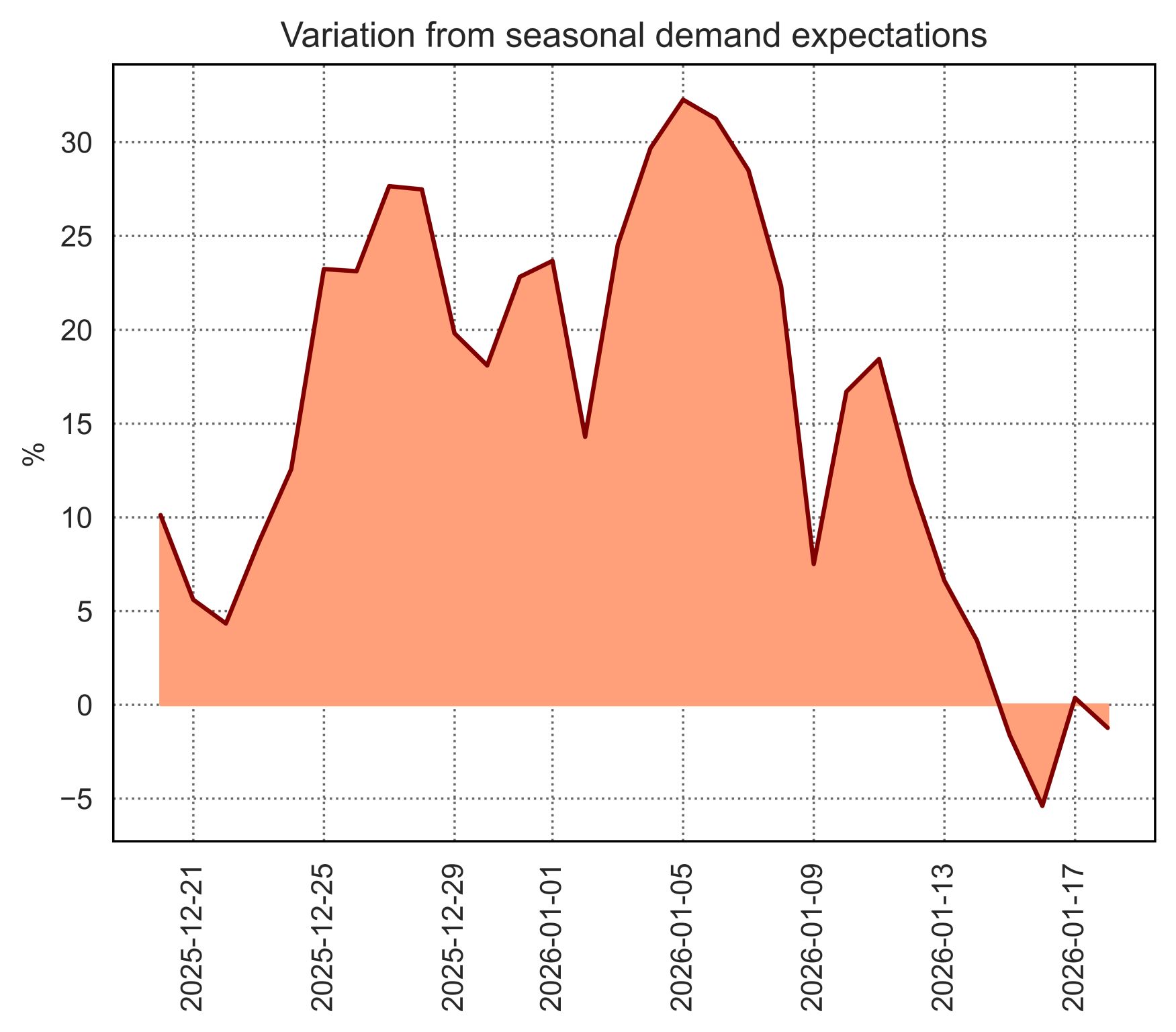

However, despite demand having been well above seasonal expectations since the last week of December, expectations for the remainder of the year have not changed materially.

Fundamentals do not justify prices reaching the levels seen at the end of last week, which are unlikely to be sustainable for more than a few weeks (provided there are no sudden geopolitical disruptions, which, these days, can never be ruled out).

While it is therefore true that the events of recent weeks will increase European LNG imports over the next 12 months, the weight of new supply is still expected to lead to a decline in prices, especially in the second half of the year.

Analysis by Giovanni Bettinelli