Recent reports have highlighted a growing conflict between the EU and Qatar over LNG shipments. Qatar has threatened to halt LNG exports to the EU unless amendments are made to the new Corporate Sustainability Due Diligence Directive (CSDDD), which could impose fines of up to 5% of a company’s annual global turnover for non-compliance.

So, how crucial is Qatar to the EU’s LNG supply, and what could be the impact of disrupted shipments?

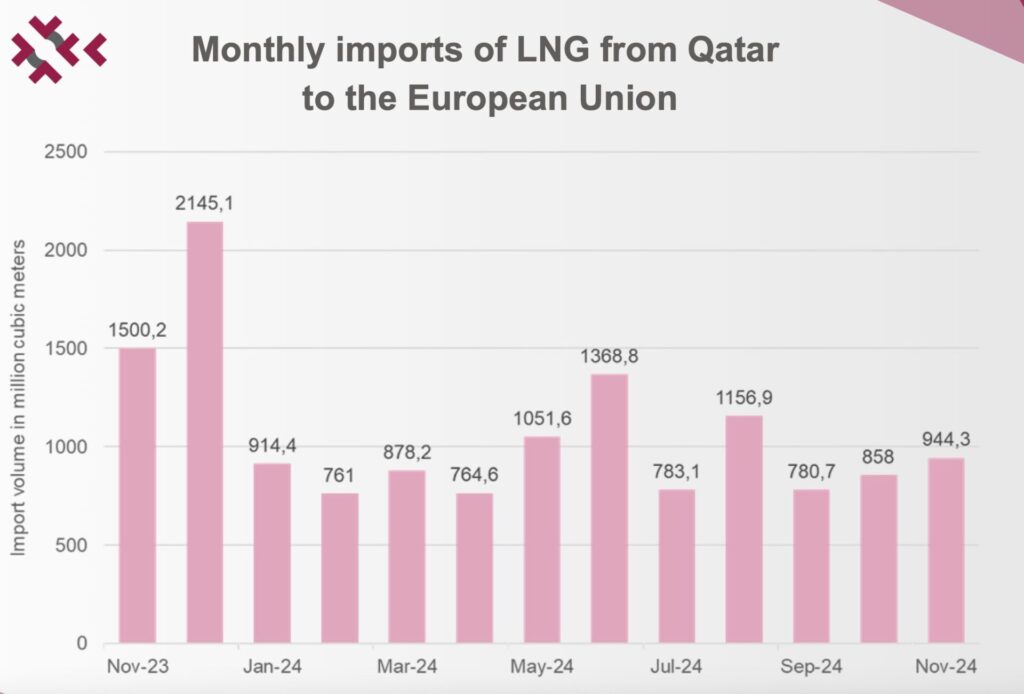

Our latest analysis reveals that Qatar’s LNG exports accounted for approximately 10% of the EU’s monthly LNG imports in 2024, making it the third-largest supplier after the U.S. and Russia.

A halt in shipments would create a significant supply gap, potentially driving up prices and even threatening supply security – especially as the EU also aims to reduce LNG imports from Russia.

Given these factors, can the EU afford to implement the directive in its current form?

Source: CEEGEX (Central Eastern European Gas Exchange)