The development of Israel’s giant Tamar and Leviathan natural gas fields has markedly shifted the regional gas market’s geopolitical dynamics. Israel’s transformation from a gas importer to an exporter has notably impacted its relationships with neighbouring Jordan and Egypt.

Israeli exports have been pivotal for Egyptian LNG exports, compensating for Egypt’s declining indigenous gas availability. Jordan, once reliant on LNG imports, cut its LNG procurement, given its access to stable Israeli pipeline supplies.

In 2022 alone, according to CEDIGAZ database, Israel’s gas exports reached 2.9 billion cubic meters (bcm) to Jordan and 6.5 bcm to Egypt, contributing to the easing of the global LNG market strain. Looking ahead, Israel aspires to broaden its gas export footprint, potentially through global LNG exports or a pipeline to Europe.

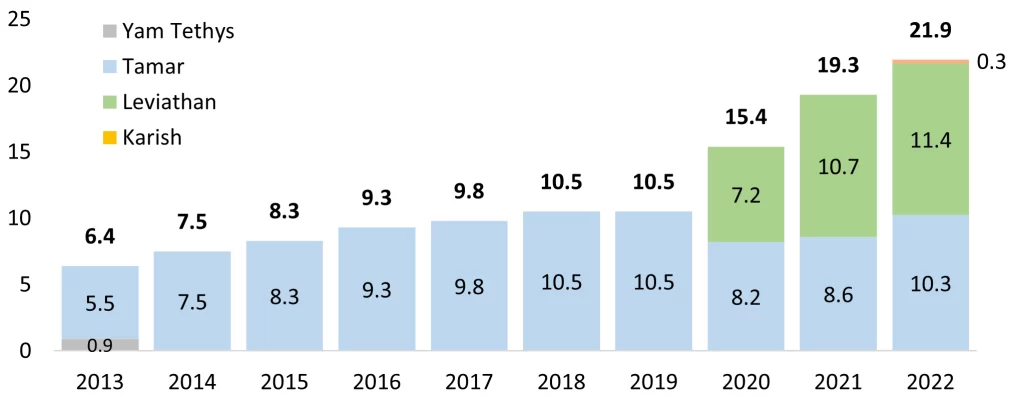

Israeli gas production in the past 10 years (2013-2022), bcm

However, the recent Israel-Hamas conflict has disrupted the regional balance. The conflict led to a one-month halt in production at the Tamar field, causing a reduction in gas exports to Egypt via the East Mediterranean Gas (EMG) pipeline. This has sparked analysts to assess the risks of further disturbances, pondering their possible cascading effects on the global gas market and Israel’s long-term gas development endeavours.

If the scale of the Israel-Hamas conflict were to enlarge, it could potentially disrupt gas exports to Jordan and Egypt in the near to medium term. In a severe yet currently unlikely scenario, where gas flows to both nations are extensively interrupted, the already stretched LNG market would face additional pressure.

Future expansion plans for Israel’s gas export capabilities might also be impacted. The recent strain in Israel-Turkey relations adds uncertainty to the previously discussed project of a new pipeline from Israel to Turkey.

Despite these challenges, major industry players like Chevron and BP, alongside ADNOC, are continuing their investment plans in Israel’s gas sector, signalling resilience and long-term commitment to the region’s energy development.

Source: Cedigaz