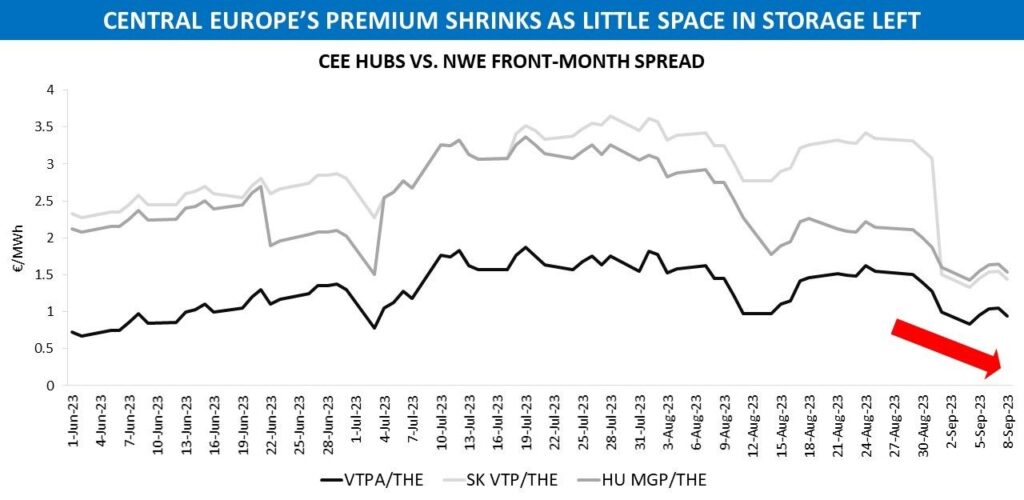

As European gas storages approach unprecedentedly high levels of fullness, interesting developments are unfolding not only with the time spreads but also within the field of locational ones.

Since the start of September, most Central European hubs have seen a strong decrease in front-month prices relative to Northwest Europe. The exception is Czech Republic, which after moving away from Russian gas (or losing it, call it whatever you want) needs spot volumes from Germany on a regular basis to cover its domestic demand. This provides constant support to Czech VTP prices against THE.

Coming back to the others in the region, there is no need to write many words about the reasons for the change in CEE/NWE spreads for October delivery. Without going into much detail, it would be enough to answer two questions to understand what is standing behind it from a market fundamentals perspective.

The first question is what EU countries now have the most filled underground sites? Among those with more or less significant amount of storage capacity, Slovakia (~97% full) and Austria (~93%) are in the top 5. Hungary’s facilities are 92% full, seeing an increase in fullness level of about 22 p.p. over the last two months vs. +14 p.p. in Germany, for example.

The second question is how much space in CEE storages is still available for injections. As of early September, less than 1.5 bcm of space was left to fill in Austria, Hungary, Czech Republic and Slovakia combined.

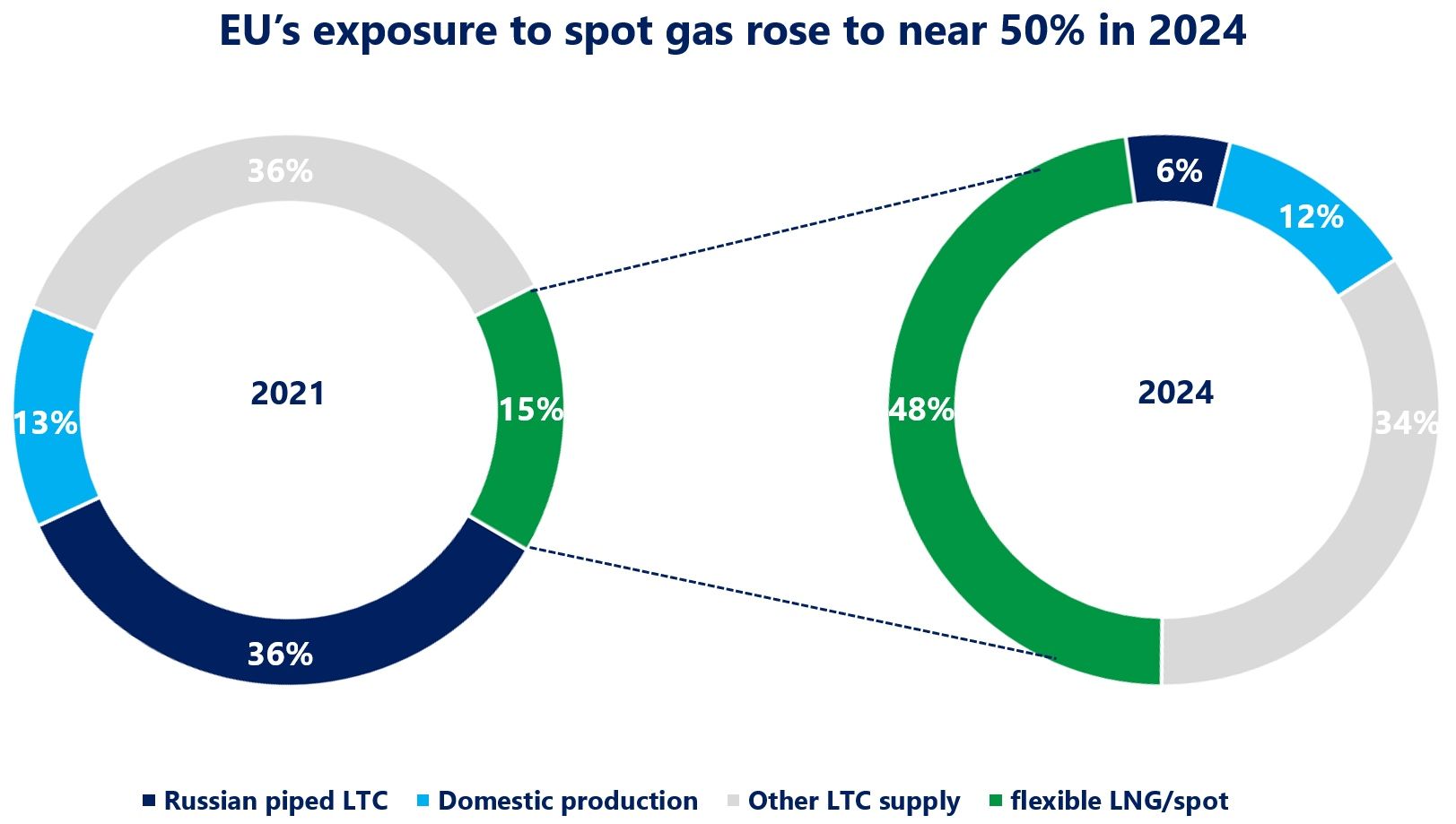

Now, have a look into how much of supply coming to the region is contracted and the dynamics should become clear.

Source: Yakov Grabar (LinkedIn)