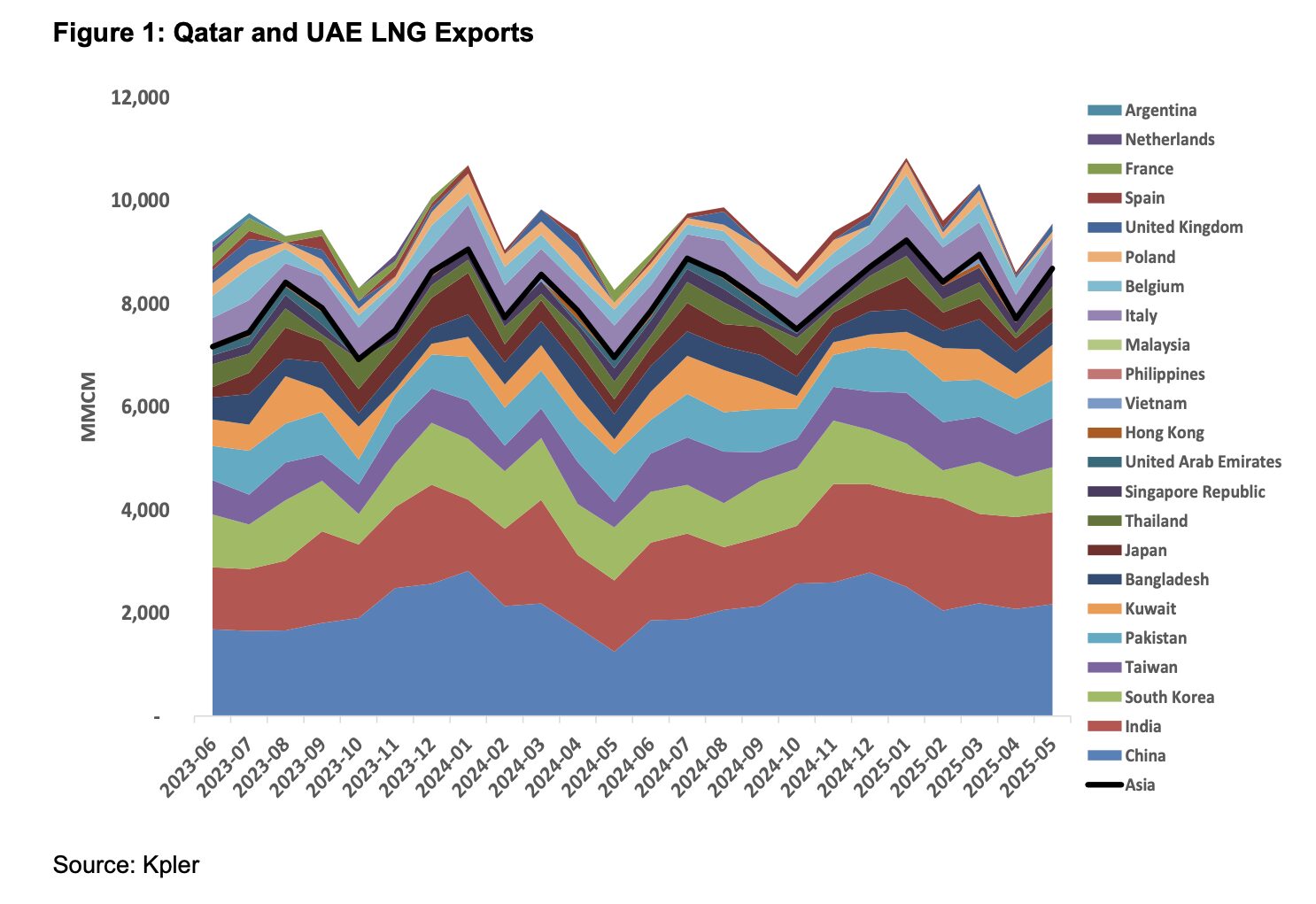

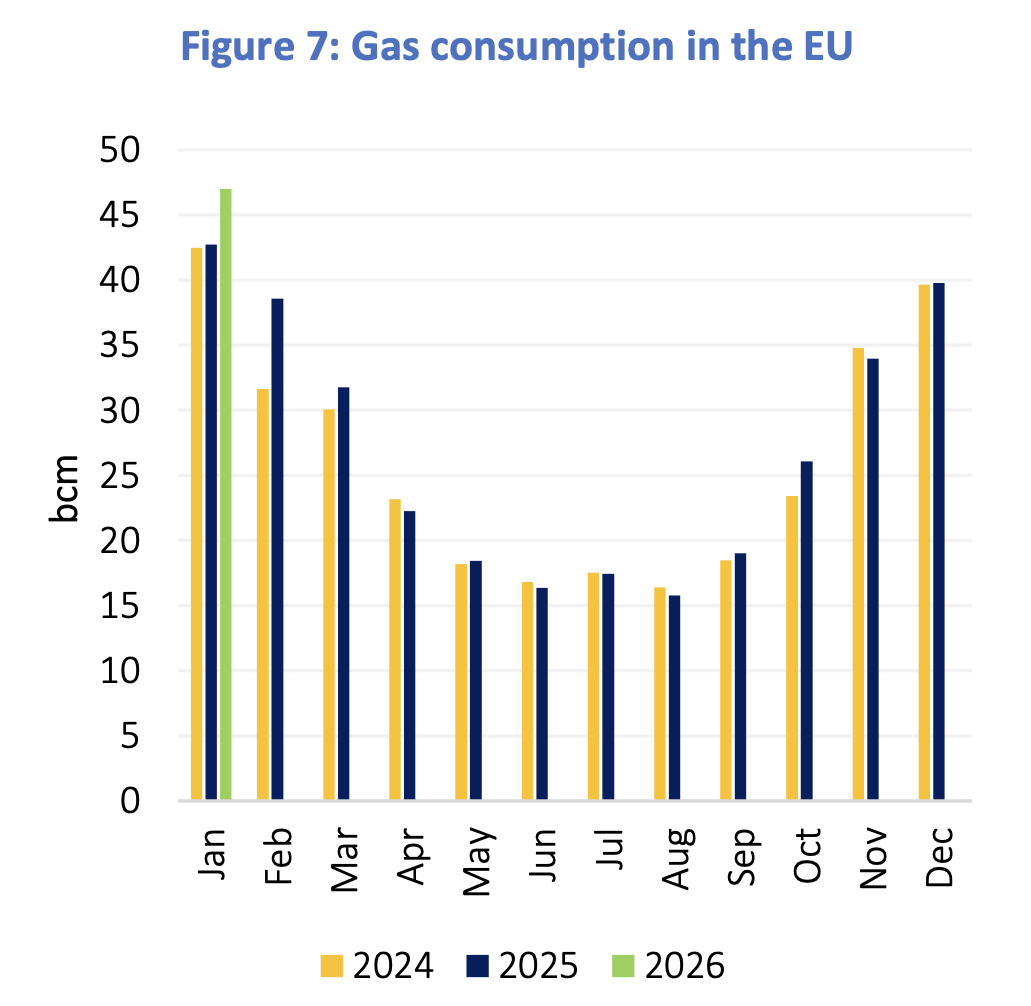

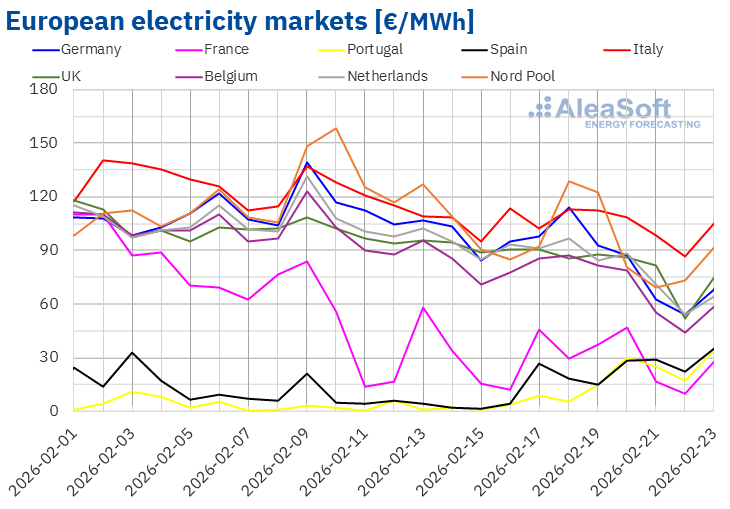

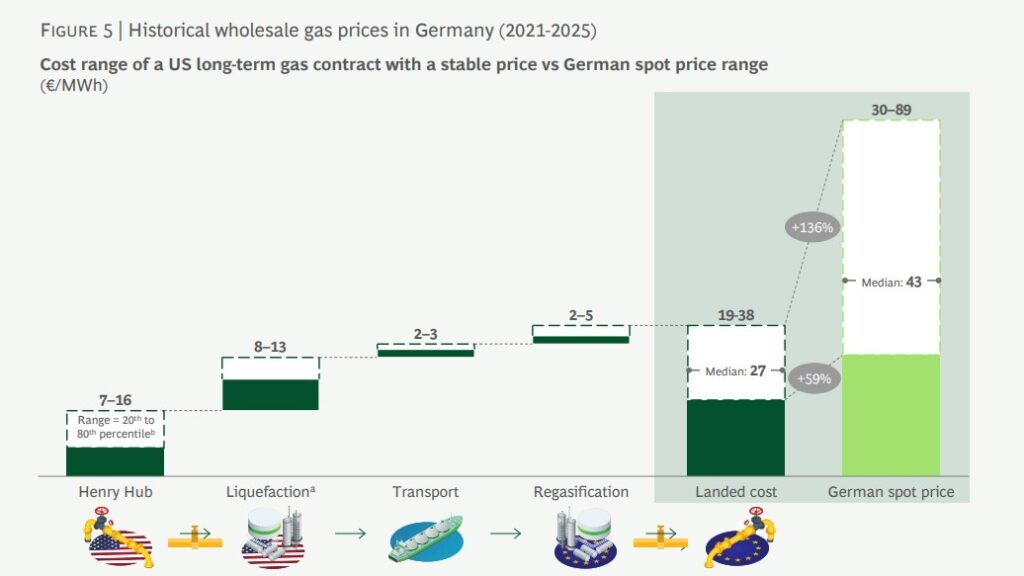

The authors argue that Europe remains over-exposed to spot gas volatility, with ~28% of LNG needs currently unsecured and the share potentially rising to ~47% by 2030 without new deals. It makes the case for long-term LNG contracts – often achievable around ~€25–30/MWh (HH-linked landed cost) – to stabilise prices, protect industrial competitiveness, and capitalise on a near-term wave of pre-FID […]