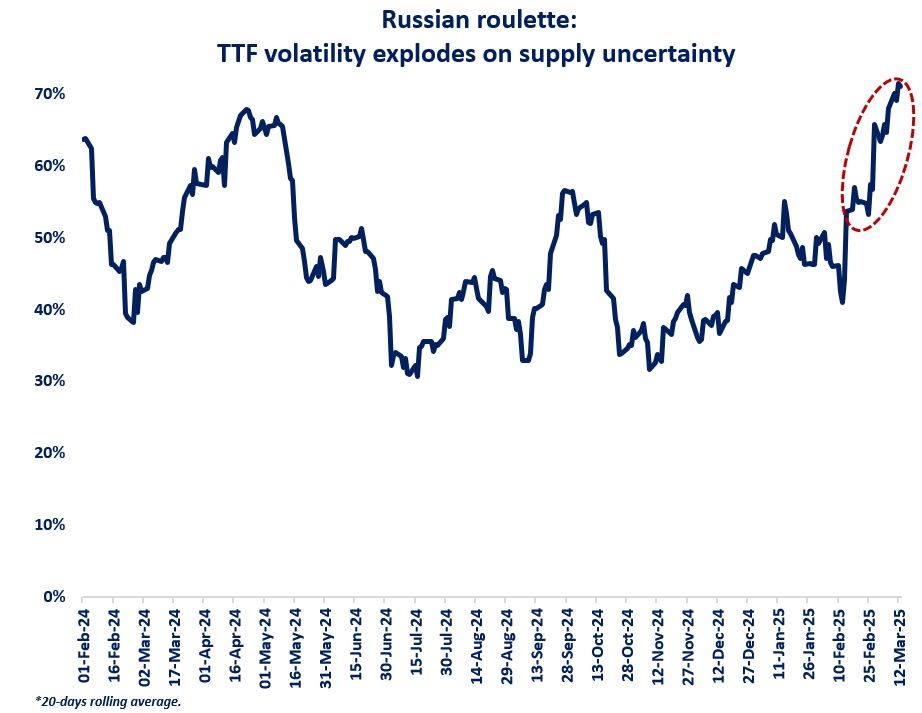

TTF price volatility exploded to a year high since the start of March, with supply uncertainty and rapidly varying demand patterns feeding additional short-term price variability.

The single most important driver for price swings seems to be the speculations that Russian gas exports to Europe could ramp-up if a peace agreement is reached between Russia and Ukraine.

Considering the geopolitical complexity at play, such talks could take months, and unlikely to have an impact on Russian gas deliveries to Europe through the 2025 filling season.

And of course, in Ukraine it would be a very difficult sell in terms of domestic politics to restart gas transit flows through the pipelines which recently were used in military operations (see Kursk operation).

Very importantly, European buyers would need to agree to buy additional volumes of Russian gas. This could be hindered by several issues, including: unresolved legal disputes with Gazprom, broken trust and confidence, public perception.

The coming weeks will be dominated by proposals, announcements and rumours around Russian gas to Europe, and TTF will certainly continue to display a great deal of volatility.

Meanwhile the European gas balance is becoming increasingly tight: with the EU’s storage deficit compared to last year rising from just 16 bcm at the start of Feb, to 25 bcm by early March… and my bet is that Russian gas won’t be here for this summer.

What is your view? How will the European gas market evolve through this summer? More volatility ahead? What is your bet on the Russian roulette?

Source: Greg MOLNAR